View: https://youtu.be/kdK7AUVtELg

Starvation Diet

“It’s important to recognize that net zero demands a transformation of the entire economy.” – Larry Fink We are on the cusp of a significant mass starvation event of our own making. Soon, tens of millions of the world’s most impoverished people will die from an inability to feed themselves...

Starvation Diet

Doomberg

Oct 10, 2021

216

41

“It’s important to recognize that net zero demands a transformation of the entire economy.” – Larry Fink (emphasis added)

We are on the cusp of a significant mass starvation event of our own making. Soon, tens of millions of the world’s most impoverished people will die from an inability to feed themselves, while many of those comfortably getting by now – especially in the Western World – are in for a shock.

The leaders who put us in this position are doubling down on their misguided energy policiesand will continue to do so until they are overthrown. I doubt they will go peacefully. Between now and then, they will use all manner of surveillance tools to spread Orwellian propaganda, misdirect blame, and crush dissent. Leading technology companies will greedily facilitate this modern incarnation of the Great Leap Forward, imaginary utopian ends justifying all manner of grotesque means.

Other than that, things are great.

For the latest evidence that society is hurtling into an immovable wall at top speed, we turn once again to the fertilizer market and connect a few dots for our readers. Monumental news broke at the end of September, and yet almost no mainstream outlet is covering it. We expect that to change shortly. For now, we turn to Progressive Farmer for a summary:

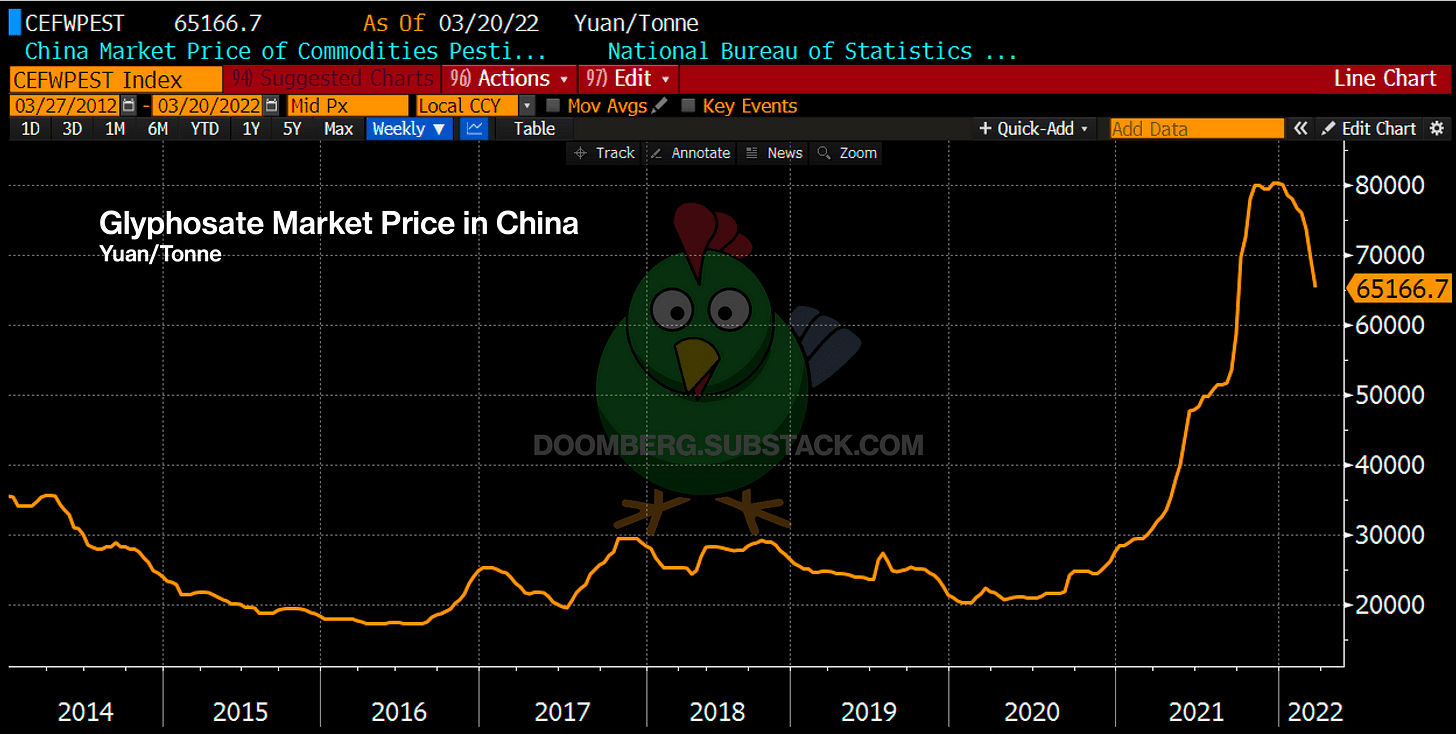

We’ve written extensively about how the market for energy in Europe broke and how the ripple effects will snap through our delicate supply chains like a whip. When the supply of critical goods goes short, countries implement protectionist policies in a futile attempt to minimize the impact at home. A cascading series of retaliatory moves usually follows, leading to economic vapor lock. We are seeing that pattern play out now in agriculture.“The move by China earlier this week to ban phosphate exports until at least June of next year puts even more pressure on global phosphate trade. The U.S. doesn't buy much phosphate from China, but the country represents about 30% of world trade. Now China's traditional buyers will be looking elsewhere.”

To keep the chemistry lesson as simple as possible, you need natural gas to produce ammonia and energy from fossil fuels to mine for phosphate. You need ammonia and phosphate to make fertilizer. You need fertilizer to grow food at scale. You need food to keep the peace.

As you might expect, the price of fertilizer – already under pressure from gyrations in the natural gas sector globally – skyrocketed higher on the news that China is halting all phosphate exports. Farmers will either raise prices dramatically or go broke. Inevitably, we’ll see an unhealthy mix of both.

Inflation in the food sector, already running hot, is set to go vertical. The combination of higher costs, lack of supply, labor shortages, and broken logistics has set in motion a crisis which can no longer be avoided. Prepare accordingly.

The opening quote of this piece comes from the 2021 edition of Larry Fink’s annual letter to CEOs. As CEO and Chair of BlackRock, Fink is one of the richest and most powerful people on earth (that’s him below, choking off the supply of fossil fuels). Through a perversion of financial engineering and scientific illiteracy, we’ve delegated the fate of humanity to a man whose claim on this power derives from his ability to vacuum up pension fund allocations. The caviar, Kobe beef, and white Alba truffles at Fink’s cocktail parties will undoubtedly continue to flow, but he would be wise to keep a keen eye on the wait staff. Somehow, I doubt he is a good tipper.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

Tracy (???) @chigrl

Tracy (???) @chigrl