Drareg

Member

- Joined

- Feb 18, 2016

- Messages

- 4,772

Wall Street Bets is a Reddit thread started in 2012, it was mainly for folks looking for stocks/stonks to buy or short, as the years passed it grew, I signed up in 2018, after the covid market drop they passed 1 million users, a few days ago this jumped to over 5 million. It’s user base really grew since the stock trading app robin hood started.

Its made up of a few experienced traders it seems but its mainly amateurs.

Here is the simplified version of story, when an objective story is printed I will post it, it’s a bit messy but I wanted to start a thread to highlight how corrupt and rigged the financial system is, this is the perfect live example unfolding!

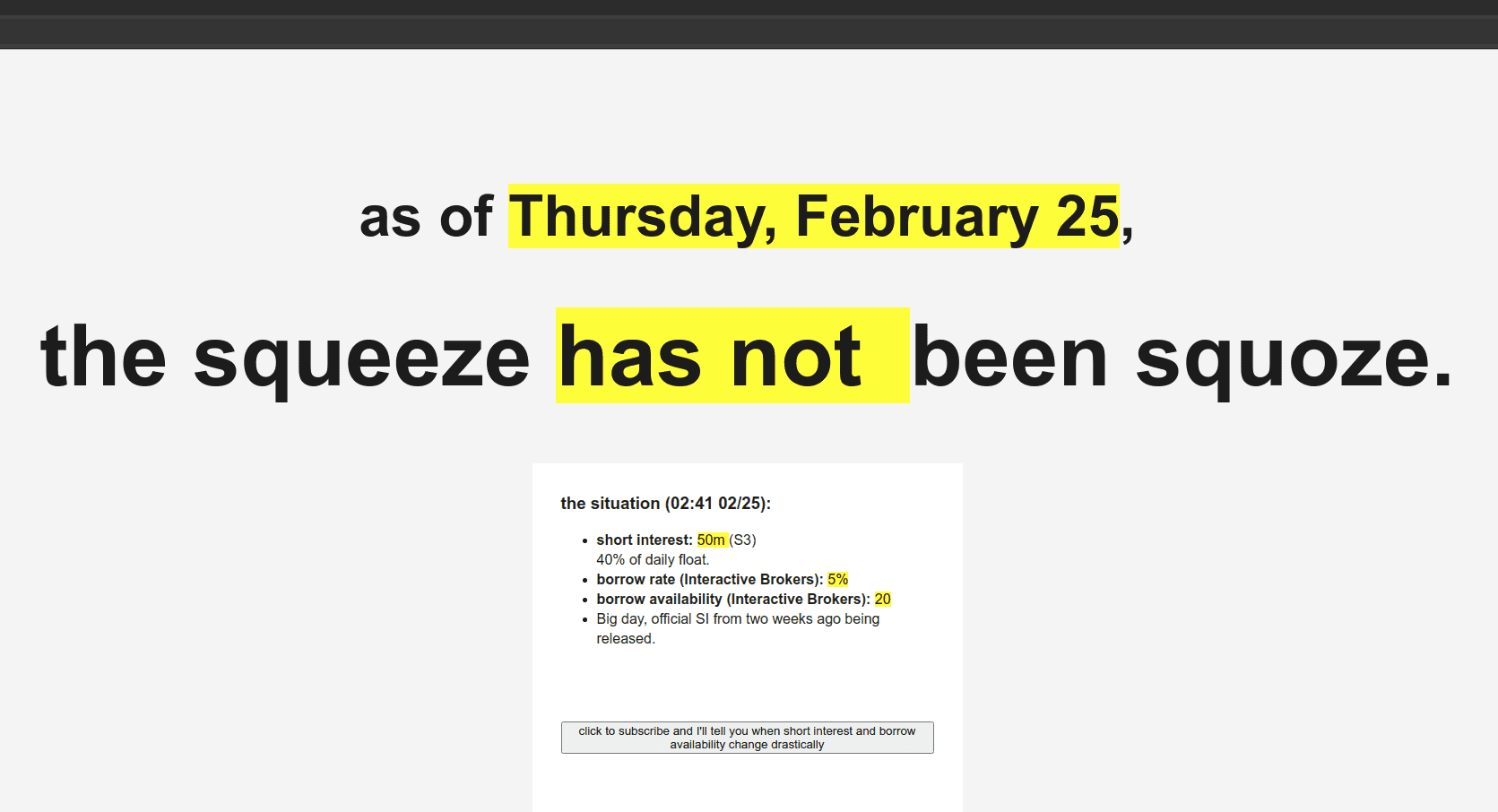

Basically a few weeks ago they seen a change in CEO at GameStop(GME), major hedge funds were betting against game stop, shorting the stock, the folks on Wall Street bets decided the stock would go up because the new CEO was talented, they started a huge pump, basically thousands of users started buying GME, the price went from around 18 dollars to 347dollars in less than a few days, it’s now back at 197 dollars because wall streets big banks are dumping it in the off hours to save mervin capital, if mervin capital goes under it could have a knock on effect.

Its unfolding here -https://www.reddit.com/r/wallstreetbets/

One hedge fund Mervin capital had shorted GME, when the WSB pump began they started to loose money and could potentially go under, this is a huge development in the world of finance.

Mervin capital had to get funds from another big bank to stay afloat, the MSM via MSNBC started pumping fake news that mervin had liquidated there position in GME at a loss, this was a lie, folks on WSB checked the SNC fillings. They have also started the narrative that WSB is the far right!

The big banks were even trading overnight to drive the price down again, retail traders can’t do this.

Big players in the financial world are crying that WSB are engaging in market manipulation, something the big banks have been doing for years! An investigation is needed they say! Remember the big sell off before covid19 hit, senators selling their stocks etc ?

Since then Robin Hood have stopped users from trading GME while big banks can still trade on it, basically they are trying to force stop losses on GME retail traders or make sure there puts don’t pay out, it’s complete fraud, Wall Street has really been exposed since this started. The folks on WSB are refusing to give in and are exposing the tactics been used, they are holding their stocks and will pump again when the markets open, the stock exchange want to halt trading on GME stocks!

Whats happened is WSB over time has figured out that information and meaning can drive stock prices regardless of the underlying financials, the big banks have been in cahoots with the MSM using this tactic for years, now the peasants can engage in crowdsourcing a pump on a stock they are crying foul!

Its made up of a few experienced traders it seems but its mainly amateurs.

Here is the simplified version of story, when an objective story is printed I will post it, it’s a bit messy but I wanted to start a thread to highlight how corrupt and rigged the financial system is, this is the perfect live example unfolding!

Basically a few weeks ago they seen a change in CEO at GameStop(GME), major hedge funds were betting against game stop, shorting the stock, the folks on Wall Street bets decided the stock would go up because the new CEO was talented, they started a huge pump, basically thousands of users started buying GME, the price went from around 18 dollars to 347dollars in less than a few days, it’s now back at 197 dollars because wall streets big banks are dumping it in the off hours to save mervin capital, if mervin capital goes under it could have a knock on effect.

Its unfolding here -https://www.reddit.com/r/wallstreetbets/

One hedge fund Mervin capital had shorted GME, when the WSB pump began they started to loose money and could potentially go under, this is a huge development in the world of finance.

Mervin capital had to get funds from another big bank to stay afloat, the MSM via MSNBC started pumping fake news that mervin had liquidated there position in GME at a loss, this was a lie, folks on WSB checked the SNC fillings. They have also started the narrative that WSB is the far right!

The big banks were even trading overnight to drive the price down again, retail traders can’t do this.

Big players in the financial world are crying that WSB are engaging in market manipulation, something the big banks have been doing for years! An investigation is needed they say! Remember the big sell off before covid19 hit, senators selling their stocks etc ?

Since then Robin Hood have stopped users from trading GME while big banks can still trade on it, basically they are trying to force stop losses on GME retail traders or make sure there puts don’t pay out, it’s complete fraud, Wall Street has really been exposed since this started. The folks on WSB are refusing to give in and are exposing the tactics been used, they are holding their stocks and will pump again when the markets open, the stock exchange want to halt trading on GME stocks!

Whats happened is WSB over time has figured out that information and meaning can drive stock prices regardless of the underlying financials, the big banks have been in cahoots with the MSM using this tactic for years, now the peasants can engage in crowdsourcing a pump on a stock they are crying foul!