Inaut

Member

- Joined

- Nov 29, 2017

- Messages

- 3,620

Buy miners for the volatility and huge upswing potential in the near term. Then sell your mining stocks and buy phyzzzzz silver when the bull market is full steam ahead. When the gold/silver ratio gets down closer to 1:20, sell your silver and buy gold. Then buy something with your gold. That's the game plan for anybody looking to play the odds. Or just buy phyzzz and hold it for your life---IDK

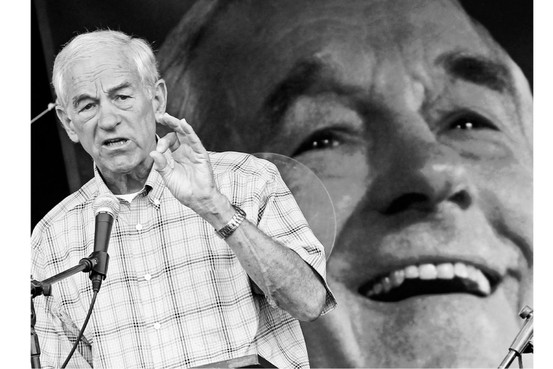

Ron Paul portfolio: 'Craziest' we've ever seen?

Ron Paul loves gold, but how much the former presidential candidate loves the yellow metal could strike some as a bit...extreme.www.cnbc.com

most of his money is in mining stock, at least while he was running for president and had to make his financials public

he's been telling people buy gold and silver, i think gold and silver mining stock to him is the second best option and a way to hold more money without needing a vault. he's definitely not running a get quick rich scheme, but he's certainly profited off his pro-gold standard discourse