Bitcoin is gold 2.0. It has the strictly limited supply of gold (in fact even more limited as 21 million can only be produced and many are lost forever). It is also the only store of value that cannot be censored or seized and can be "sent" to anywhere in the world within minutes. Yes, the price is volatile, but the volatility is slowly decreasing over time.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

By using this site you agree to the terms, rules, and privacy policy.

-

Charlie's Restoration Giveaway #2 (Entire Home EMF Mitigation & Protection Along With Personal Protection) - Click Here To Enter

-

Dear Carnivore Dieters, A Muscle Meat Only Diet is Extremely Healing Because it is a Low "vitamin A" Diet. This is Why it Works so Well...

Rest the rest of this post by clicking here

-

The Forum is transitioning to a subscription-based membership model - Click Here To Read

Click Here if you want to upgrade your account

If you were able to post but cannot do so now, send an email to admin at raypeatforum dot com and include your username and we will fix that right up for you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How Do People Feel About The Up Coming Economic Collapse?

Ulysses

Member

- Joined

- Feb 13, 2018

- Messages

- 340

Not feeling great about it. Still in graduate school and have no real money of my own, so it doesn't feel like there's anything I can do to protect myself or my family. My parents have some money, but of course they're completely invested in the system and there's no way I could convince them to do something different. I try to just not think about it, and hold out hope for another five years of stability.

It's a given that there will be an end to the USD hegemony. It happens to all dominant powers and the powers that be have certainly been planning that as part of their globalist agenda. Trump is a monkey wrench in the spokes of that plan, for now. Administrations have expiration dates, globalists aren't going anywhere and, as has been pointed it for decades, the math can't be ignored indefinitely. The longer the event is forestalled the greater the eventual fall. When it comes, the enormous transfer of wealth will make a few very affluent from a modest investment while the majority pay with losses.

Hypothetically, if one knew the approximate date of said collapse a year (or two) in advance, down to the week, let's say, what could one do to maximize its very short term profit potential? The premise may seem far-fetched, but these events do tend to cluster at certain times of year.

One example strategy might be to buy short, leveraged ETFs for the major market indexes a little ahead of the expected crisis and cash out quickly afterward. That capitalizes on the plunge itself. If the collapse didn't happen you just cash out perhaps with some minor losses, but at least you'd be pre-positioned without too much risk if it didn't pan out that time around.

Any ideas on what else one could do with, say, $30K to position to capitalize on the sudden, steep decline, assuming that decline would be an irrevocable shift in global markets away from a lost US hegemony, not a flash crash leading to recovery?

Hypothetically, if one knew the approximate date of said collapse a year (or two) in advance, down to the week, let's say, what could one do to maximize its very short term profit potential? The premise may seem far-fetched, but these events do tend to cluster at certain times of year.

One example strategy might be to buy short, leveraged ETFs for the major market indexes a little ahead of the expected crisis and cash out quickly afterward. That capitalizes on the plunge itself. If the collapse didn't happen you just cash out perhaps with some minor losses, but at least you'd be pre-positioned without too much risk if it didn't pan out that time around.

Any ideas on what else one could do with, say, $30K to position to capitalize on the sudden, steep decline, assuming that decline would be an irrevocable shift in global markets away from a lost US hegemony, not a flash crash leading to recovery?

Count. DJF

Member

- Joined

- Sep 30, 2017

- Messages

- 9

It will crash. It's not sustainable.

It doesn't mean the end of humans.

It does signal a terrible time of challenge and change however.

It doesn't mean the end of humans.

It does signal a terrible time of challenge and change however.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

Bitcoin is gold 2.0. It has the strictly limited supply of gold (in fact even more limited as 21 million can only be produced and many are lost forever). It is also the only store of value that cannot be censored or seized and can be "sent" to anywhere in the world within minutes. Yes, the price is volatile, but the volatility is slowly decreasing over time.

Bitcoin can absolutely be seized. Just look at Silk Road.

Feds Claim Proceeds from Seized Silk Road Fortune at Only $334 per Bitcoin

Count. DJF

Member

- Joined

- Sep 30, 2017

- Messages

- 9

Everything can be seized.

Seizures, Caesars and Salads.

All can have synchronisation.

Seizures, Caesars and Salads.

All can have synchronisation.

Herbie

Member

- Joined

- Jun 7, 2016

- Messages

- 2,192

If we are talking civilization as we know it to primitive survival within a few days. Warm clothes, a flint and a knife. I’d be eating in surplus now so I had some fat to feed in for a while.

Carpe diem.

Carpe diem.

DaveFoster

Member

Goldman Sachs decried the risks and unpredictability of cryptocurrency, all while they tilted their portfolios toward blockchain. Other large banks, such as ScotiaBank has banned purchase of Bitcoin with their credit cards, but overall, bulge-bracket firms and many medium-sized banks have an offensive disposition and have recognized cryptocurrency as inevitable.I know you didn't say that Bitcoin was a scam, just that many others said it's a scam (and you are very correct in that). I gathered that you were at the very least interested in the concept, and wanted to share. Beyond that, I just wanted to share some scenarios that could happen with the rest of the financial system.

I certainly don't know for sure what that message means, but to me, a news headline about an ongoing financial crisis embedded in the genesis block suggests to me that it is an attempt to replace the current, failing system. When you look at the ecosystem that has sprung up around Bitcoin (along with Bitcoin itself) in less than a decade (BTC will be 10 years old this January), it is truly amazing. Bitcoin, Litecoin, Bitcoin Cash, Monero, and lots of others as currencies that can't be diluted by a central authority. Platforms like Ethereum, Cardano, Qtum, and Neo where apps, dapps, and businesses can build on. Businesses like Populous, Salt, Civic, and OMG that are building on these platforms. The concept of the ICO as an alternative to Venture Capital or IPOs. Even existing businesses issuing asset backed coins-

Now, I haven't seen Kevin O'Leary speak about this since (wouldn't doubt he was told by someone to be quiet about it, or it got delayed, or something), but the concept is valid, and I think it's more a matter of "when" rather than "if" something like that happens. Compare that with the issues that Patrick Byrne mentions in his CATO speech, and you have a lot of major problems solved. Very exciting.

As a mobile application, Square simplifies and speeds transactions for cab drivers, retail stores and coffee shops, but their mobile app pairs with credit card transactions and doesn't serve as an alternative currency. The volatility and recent "Bitcoin bubble," which admittedly has imprinted Bitcoin in the minds of consumers, has left cryptocurrency as an uncertain substitute for dollars, much less currency. It's a far-cry to assume its widespread adoption within the next five or even ten years, at least for use in everyday transactions.

Pablo Cruise

Member

All I can say to the original statement is absurd. Sure there will be ups and downs but with a GDP of 4.2 as long as capitalists (not Obama and the Dems) are in power I am not going to worry about China and Iran. If Amarsh studies currencies he should know China has been pushing for the Yuan to be another world currency for long time. As long as Trump is around, the U.S. will not let other countries take advantage economically or militarily....worry after Trump's second Presidency.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

Goldman Sachs decried the risks and unpredictability of cryptocurrency, all while they tilted their portfolios toward blockchain. Other large banks, such as ScotiaBank has banned purchase of Bitcoin with their credit cards, but overall, bulge-bracket firms and many medium-sized banks have an offensive disposition and have recognized cryptocurrency as inevitable.

Goldman did a lot more than just tilt their portfolios toward blockchain. They purchased an entire cryptocurrency exchange-

https://coincentral.com/goldman-sachs-funded-circle-purchases-poloniex-400mln-buyout/

As a mobile application, Square simplifies and speeds transactions for cab drivers, retail stores and coffee shops, but their mobile app pairs with credit card transactions and doesn't serve as an alternative currency. The volatility and recent "Bitcoin bubble," which admittedly has imprinted Bitcoin in the minds of consumers, has left cryptocurrency as an uncertain substitute for dollars, much less currency. It's a far-cry to assume its widespread adoption within the next five or even ten years, at least for use in everyday transactions.

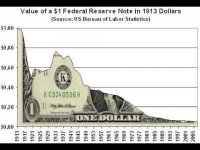

Anytime "volatility" has been mentioned in regards to Bitcoin, that is used in regards to it's price in US Dollars. The recent bubble could more accurately be described as the "Bitcoin Price Bubble." Considering one purpose of Bitcoin (and/or other cryptos) might be to replace the US Dollar, I don't see how this is the most valid criticism. Even with all of this volatility, any amount of Bitcoin purchased in October 2017 or before has either maintained or gained value in USD. That's not true for the dollar itself, or Silver, or Gold.

As for whether or not cryptos will be used in everyday transactions, they very well might be without consumers or merchants even knowing it. Look into companies like TenX, TokenPay, and TokenCard. Or better yet, look into Mastercard, a company pretty much everyone has heard of, and look into the Lightning Network.

managing

Member

- Joined

- Jun 19, 2014

- Messages

- 2,262

Sure, but ALL currency values can only be expressed in terms of other currencies. Cryptos should be expected to be more volatile relative to government issued currencies--and even gold--as they do not have any underlying mechanisms flattening that out. Of course there aren't other mechanisms deflating them either. This is just how cryptos are. What will reduce their volatility is wider adoption. But it should be seen as a feature of crypto, not a bug.Goldman did a lot more than just tilt their portfolios toward blockchain. They purchased an entire cryptocurrency exchange-

https://coincentral.com/goldman-sachs-funded-circle-purchases-poloniex-400mln-buyout/

Anytime "volatility" has been mentioned in regards to Bitcoin, that is used in regards to it's price in US Dollars. The recent bubble could more accurately be described as the "Bitcoin Price Bubble." Considering one purpose of Bitcoin (and/or other cryptos) might be to replace the US Dollar, I don't see how this is the most valid criticism. Even with all of this volatility, any amount of Bitcoin purchased in October 2017 or before has either maintained or gained value in USD. That's not true for the dollar itself, or Silver, or Gold.

As for whether or not cryptos will be used in everyday transactions, they very well might be without consumers or merchants even knowing it. Look into companies like TenX, TokenPay, and TokenCard. Or better yet, look into Mastercard, a company pretty much everyone has heard of, and look into the Lightning Network.

managing

Member

- Joined

- Jun 19, 2014

- Messages

- 2,262

I haven't yet seen the evidence that the political party in the whitehouse correlates with economic prosperity. Can you point me to your sources?All I can say to the original statement is absurd. Sure there will be ups and downs but with a GDP of 4.2 as long as capitalists (not Obama and the Dems) are in power I am not going to worry about China and Iran. If Amarsh studies currencies he should know China has been pushing for the Yuan to be another world currency for long time. As long as Trump is around, the U.S. will not let other countries take advantage economically or militarily....worry after Trump's second Presidency.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

Sure, but ALL currency values can only be expressed in terms of other currencies. Cryptos should be expected to be more volatile relative to government issued currencies--and even gold--as they do not have any underlying mechanisms flattening that out. Of course there aren't other mechanisms deflating them either. This is just how cryptos are. What will reduce their volatility is wider adoption. But it should be seen as a feature of crypto, not a bug.

Well, I think it's more accurate to say that this is just how cryptos are right now. It's not an inherent feature of cryptocurrency, but more the inherent feature of a new asset class. As I stated before, the oldest crypto, Bitcoin, isn't even 10 years old yet.

Although, at the same time, this may be a result of a very transparent asset class as well. The total amount of Bitcoin is known and capped- that isn't true for even silver and gold. We also know the inflation rate due to mining, and know when that will be reduced.

And again, some of the volitatilty may be due to the dollar losing the last of it's value.

Attachments

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

I haven't yet seen the evidence that the political party in the whitehouse correlates with economic prosperity. Can you point me to your sources?

He said nothing about Political Party.... he mentioned Trump specifically. Like or hate Trump, you have to admit he's different than the globalist Trilateral Commission Presidents of Bush/Clinton/Bush/Obama.

L_C

Member

- Joined

- Aug 17, 2018

- Messages

- 554

Not sure if any of you came across deagel military website and their population/gdp prediction 2025:

List of Countries Forecast 2025

It does correspond to whatever 'Amarsh213' is saying. Make sure to read notes below.

List of Countries Forecast 2025

It does correspond to whatever 'Amarsh213' is saying. Make sure to read notes below.

managing

Member

- Joined

- Jun 19, 2014

- Messages

- 2,262

He said "not obama and the dems". I'm not really trying to debate ideologies (ha ha, no, I have NO interest in that dead end). I am seriously curious if there is any proof that economic prosperity varies consistently with any particular party/person/ideology etc. I've never seen it. Which is not proof it does not exist. If something like that does exist, I'd be very interested in having a look.He said nothing about Political Party.... he mentioned Trump specifically. Like or hate Trump, you have to admit he's different than the globalist Trilateral Commission Presidents of Bush/Clinton/Bush/Obama.

DaveFoster

Member

Goldman has ~$40 billion worth of assets under management (AUM), so $400 million would be s around 1% of their total assets.Goldman did a lot more than just tilt their portfolios toward blockchain. They purchased an entire cryptocurrency exchange-

https://coincentral.com/goldman-sachs-funded-circle-purchases-poloniex-400mln-buyout/

Anytime "volatility" has been mentioned in regards to Bitcoin, that is used in regards to it's price in US Dollars. The recent bubble could more accurately be described as the "Bitcoin Price Bubble." Considering one purpose of Bitcoin (and/or other cryptos) might be to replace the US Dollar, I don't see how this is the most valid criticism. Even with all of this volatility, any amount of Bitcoin purchased in October 2017 or before has either maintained or gained value in USD. That's not true for the dollar itself, or Silver, or Gold.

As for whether or not cryptos will be used in everyday transactions, they very well might be without consumers or merchants even knowing it. Look into companies like TenX, TokenPay, and TokenCard. Or better yet, look into Mastercard, a company pretty much everyone has heard of, and look into the Lightning Network.

Even though Bitcoin tends to gain value overtime, the high volatility prevents its use for short-term investments. Further, its high liquidity makes for a poor day if you're Mr. Market, sensitive to price changes and eager to sell. For disciplined, diversified and long-term investor, cryptocurrency has value, and, although some foresee regulations. Personally, I hold Bitcoin and Litecoin and have no intention neither to liquidate my investment nor to use either in everyday transactions.

If the dollar collapses, then cryptocurrency would be my go-to. Gold might be a good investment in preparation for a collapse simply because Boomers and older Gen X'ers may have a preference for gold, inflating the price, but I haven't looked into it.

Thank you for the links, and I'll look into them.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

Goldman has ~$40 billion worth of assets under management (AUM), so $400 million would be s around 1% of their total assets.

The point wasn't so much what they paid for Poloneix, it's that they brought a pretty major crypto exchange. That's not money they put into Bitcoin or Litecoin or other cryptos. That's buying underlying infrastructure. Possibly, a prelude to them getting in cryptos far heavier than they are right now.

Fractality

Member

- Joined

- Jan 23, 2016

- Messages

- 772

Cryptos may very well be part of the new system. I doubt it will be BTC though. People banking on making a ton of money in one of the current crypto systems will likely be disappointed. BTC could easily be a pilot project which will eventually be replaced.

DaveFoster

Member

Indeed. Even 1% of Goldman's total assets entails a substantial investment, and it could mirror a recognition of value in the cryptocurrency itself. Alternatively, an acquisition of Poloniex positions Goldman to capitalize on lucrative exchange fees. Their decision assuredly reflects some measure of both.The point wasn't so much what they paid for Poloneix, it's that they brought a pretty major crypto exchange. That's not money they put into Bitcoin or Litecoin or other cryptos. That's buying underlying infrastructure. Possibly, a prelude to them getting in cryptos far heavier than they are right now.

EMF Mitigation - Flush Niacin - Big 5 Minerals