Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

By using this site you agree to the terms, rules, and privacy policy.

-

Charlie's Restoration Giveaway #2 (Entire Home EMF Mitigation & Protection Along With Personal Protection) - Click Here To Enter

-

Dear Carnivore Dieters, A Muscle Meat Only Diet is Extremely Healing Because it is a Low "vitamin A" Diet. This is Why it Works so Well...

Rest the rest of this post by clicking here

-

The Forum is transitioning to a subscription-based membership model - Click Here To Read

Click Here if you want to upgrade your account

If you were able to post but cannot do so now, send an email to admin at raypeatforum dot com and include your username and we will fix that right up for you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

High Risk Stock Trading

- Thread starter Cirion

- Start date

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

So I am a buyer and for saving a 3% for let's say a 2000usd watch sold at overstock.com I risk that in two months my btc could buy me two or three of the same watches? Or not that dramatic : that in a couple days my btc are worth a 4% less? So 1% loss. You see it makes no sense??Because you save 3% in credit card costs.

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

For the small purchases it is not worth the hassel and for big things even a 1% is A LOT of money.

I don't see it sorry.

I don't see it sorry.

Cirion

Member

3% is really nothing anyway when you consider Rewards credit cards like my southwest airlines rewards card that lets me take 1 or 2 free round trip flights a year. Even if that 3% was consistent, that's at best equal to what I'm already getting or even inferior. I have an amazon store card that gives me 5% back, and I order a lot from amazon, so that's even better than bitcoin if the only selling point for bitcoin is a 3% value.

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

It is controlled inflation man, we are not talking about Zimbawe here. And you can easily counteract the inflation putting the money into very conservative stocks, or government bonds or whatever.Well, keeping the money as USD guarantees a loss through inflation. So everyone makes their choices...

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

Now the thing I can think of is for people in countries with no monetary stabilization, from Zimbawe to Argentina to Cuba and the like. But still... for the average joe... you still risk a massive price down of BTC or when youbwant to cash it back to any localncurrency you can expect taxes and stuff...

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

So yeah I see now a use for it, for these kind of countries. But I would rather buy some diamonds or silver and put it 10m underearth in the garden.

Cirion

Member

Now the thing I can think of is for people in countries with no monetary stabilization, from Zimbawe to Argentina to Cuba and the like. But still... for the average joe... you still risk a massive price down of BTC or when youbwant to cash it back to any localncurrency you can expect taxes and stuff...

Now that seems like a valid point. There are many countries like Zimbabwe, Venezuela that have OBSCENE inflation. Last I heard, doesn't a loaf of bread cost 1 trillion local currency in Zimbabwe?

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

But you know what Cirion? If I was in a country like that and I wanted to save my money, I would rarher buy a diamond. If things go bad in your country you can put it up your ****, take a plane to London or Brusels, sell it to a jewish jeweler and get your money in a safe currency like EUR or GBP.Now that seems like a valid point. There are many countries like Zimbabwe, Venezuela that have OBSCENE inflation. Last I heard, doesn't a loaf of bread cost 1 trillion local currency in Zimbabwe?

If you tie yourself to one shop then why not use bitcoin at that? purse.io lets you trade bitcoin for amazon orders and you get 10-50% discount3% is really nothing anyway when you consider Rewards credit cards like my southwest airlines rewards card that lets me take 1 or 2 free round trip flights a year. Even if that 3% was consistent, that's at best equal to what I'm already getting or even inferior. I have an amazon store card that gives me 5% back, and I order a lot from amazon, so that's even better than bitcoin if the only selling point for bitcoin is a 3% value.

Cirion

Member

If you tie yourself to one shop then why not use bitcoin at that? purse.io lets you trade bitcoin for amazon orders and you get 10-50% discount

Ok well 50% discount, now we're talking. I don't know anything about that. It sounds worth looking into though.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

But you know what Cirion? If I was in a country like that and I wanted to save my money, I would rarher buy a diamond. If things go bad in your country you can put it up your ****, take a plane to London or Brusels, sell it to a jewish jeweler and get your money in a safe currency like EUR or GBP.

You could do the same thing with Cryptos, and you wouldn't even have to potentially aggravate your GI tract with a foreign object.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

Now the thing I can think of is for people in countries with no monetary stabilization, from Zimbawe to Argentina to Cuba and the like. But still... for the average joe... you still risk a massive price down of BTC or when youbwant to cash it back to any localncurrency you can expect taxes and stuff...

Ah, "Monetary Stabilization." That's a nice sounding way of saying "The Taxpayers are Forced To Bail Out The Bankers." Or "The Markets are Rigged."

LeeLemonoil

Member

- Joined

- Sep 24, 2016

- Messages

- 4,265

In a more practical sense, if there will ever be a similar Bitcoin-rise as 2 years ago, you can always jump on the bandwagon when the tendency is reasonably clear and still take in huge profits. Maybe not like if you speculated when it was at the bottom ... but many people 2 years ago made good gains weeks into the bitcoin rise ... even a few days before the peak. The gains are not extreme but neither would the risks be

LeeLemonoil

Member

- Joined

- Sep 24, 2016

- Messages

- 4,265

I think if Bitcoin ever shows serious signs of going up seriously again, FOMO would be a huge factor - almost a guarantee that an value-explosion will occur. Everybody now remembers the last time - FOMO will be ridiculous

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

We are going in circles here tanka? What part of tomorrow your BTC can be worth half its value you don't want to accept?You could do the same thing with Cryptos, and you wouldn't even have to potentially aggravate your GI tract with a foreign object.

Diamonds :

I would risk my GI tract.

tankasnowgod

Member

- Joined

- Jan 25, 2014

- Messages

- 8,131

We are going in circles here tanka? What part of tomorrow your BTC can be worth half its value you don't want to accept?

Diamonds :

I would risk my GI tract.

Then put it in a Stable Coin like TUSD or USDC. Boom, still no problem with orafices.

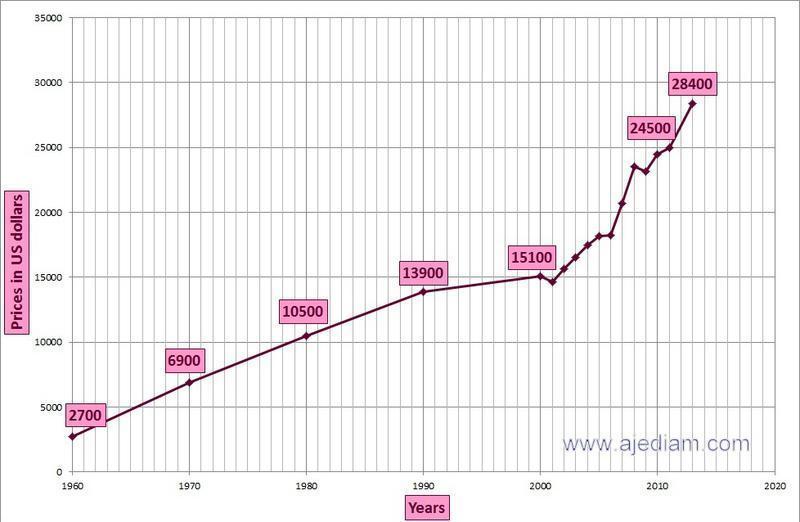

By the way, if you are going to attach a chart talking about potential daily losses, you should not attach yearly chart to make your point.

Makrosky

Member

- Joined

- Oct 5, 2014

- Messages

- 3,982

You get the idea man... no need to go to such fine details.Then put it in a Stable Coin like TUSD or USDC. Boom, still no problem with orafices.

By the way, if you are going to attach a chart talking about potential daily losses, you should not attach yearly chart to make your point.

Anyway I didn't know about USDC. I'll have to look at it.

Pdohlen

Member

- Joined

- Jul 27, 2018

- Messages

- 59

I have been testing long-only strategy on Nasdaq from 1971 until today. CAGR unlevered 11%, not bad at all. If you apply a volatility filter to this and add leverage you can up this to almost 30% pro anno.

More specifically:

In a low volatile period, go long with 5*leverage, i.e. if you start with 10k capital, get an exposure to Nasdaq for 50k.

Run a spreadsheet and keep note on closing quotes for Nasdaq. Continually calculate standard deviation (stdev) for the previous 10days. If Stdev goes above 1.1 - half your position. If stdev goes above 1.7 close the rest of your positions.

When stdev goes below 1.7 again - > reenter with half (2.5*leverage), and when it goes below 1.1 go into full exposure again -> 5*leverage.

On average you would make approximately two trades a month, scaling adjusting positions, controlling your exposure to fit the current risk aversion/tolerance seen in the market. When tolerance is low, volatility rises, and you scale down.

More specifically:

In a low volatile period, go long with 5*leverage, i.e. if you start with 10k capital, get an exposure to Nasdaq for 50k.

Run a spreadsheet and keep note on closing quotes for Nasdaq. Continually calculate standard deviation (stdev) for the previous 10days. If Stdev goes above 1.1 - half your position. If stdev goes above 1.7 close the rest of your positions.

When stdev goes below 1.7 again - > reenter with half (2.5*leverage), and when it goes below 1.1 go into full exposure again -> 5*leverage.

On average you would make approximately two trades a month, scaling adjusting positions, controlling your exposure to fit the current risk aversion/tolerance seen in the market. When tolerance is low, volatility rises, and you scale down.

Last edited:

EMF Mitigation - Flush Niacin - Big 5 Minerals

Similar threads

- Replies

- 23

- Views

- 3K

- Replies

- 8

- Views

- 2K

- Replies

- 2

- Views

- 3K

- Replies

- 33

- Views

- 4K

- Replies

- 369

- Views

- 52K

- Replies

- 5

- Views

- 5K

- Replies

- 5

- Views

- 1K

- Replies

- 17

- Views

- 2K

- Replies

- 26

- Views

- 5K

- Replies

- 38

- Views

- 6K

- Replies

- 68

- Views

- 27K

- Replies

- 9

- Views

- 1K